Note that substitute forms may be used, but the substitute forms must include all of the information required by Forms 1094C and 1095C and must satisfy all of the IRS's form and content requirements Forms 1094B and 1095B are to be used by a small selfinsured employer that is not an ALE for Section 6055 purposes17/2/16 · Form 1095 C Employee Communication (50 Fully Insured Plan) Form 109 5C Employee Communication (50 SelfInsured Plan) HR360's sample letters include Explanations of why the employee is receiving Form 1095C;Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax credit

Sample 1095 C Forms Aca Track Support

How to use form 1095-c

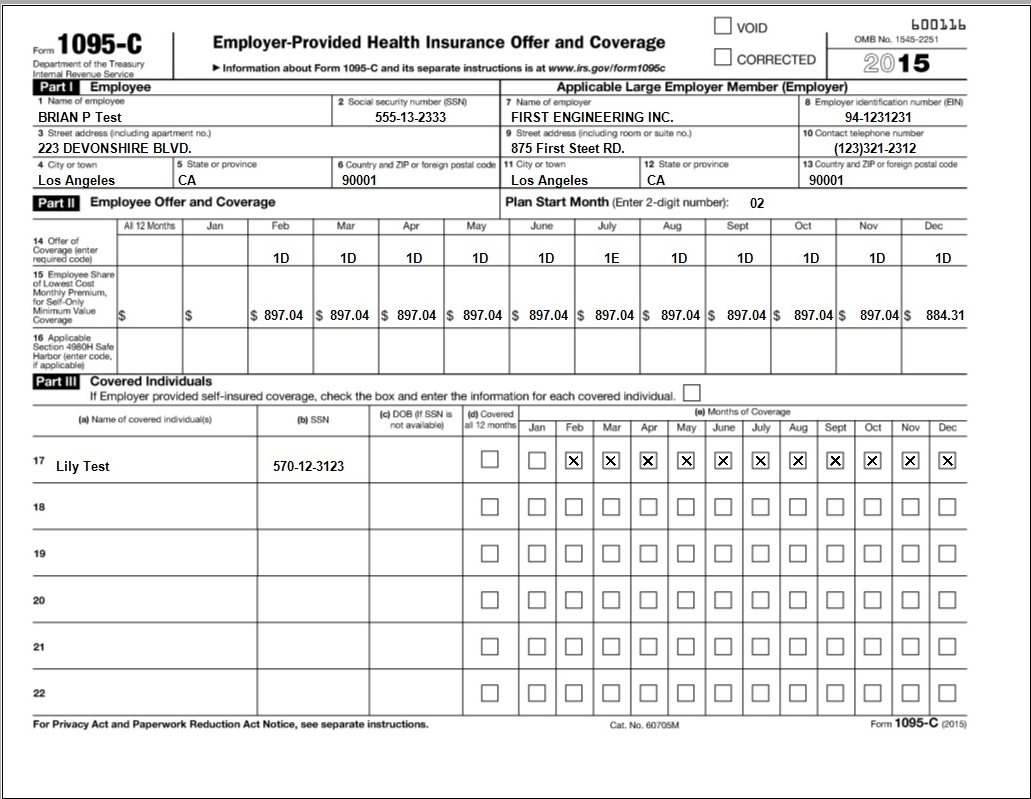

How to use form 1095-c-FullTime Employee Hired Midyear;Form 1095C is used by applicable large employers (as defined in section 4980H(c)(2)) to verify employersponsored health coverage and to Form1095C Colorado State University Colorado State University provides employees with the 1095C tax form

1095 C Fillable Form Fill Out And Sign Printable Pdf Template Signnow

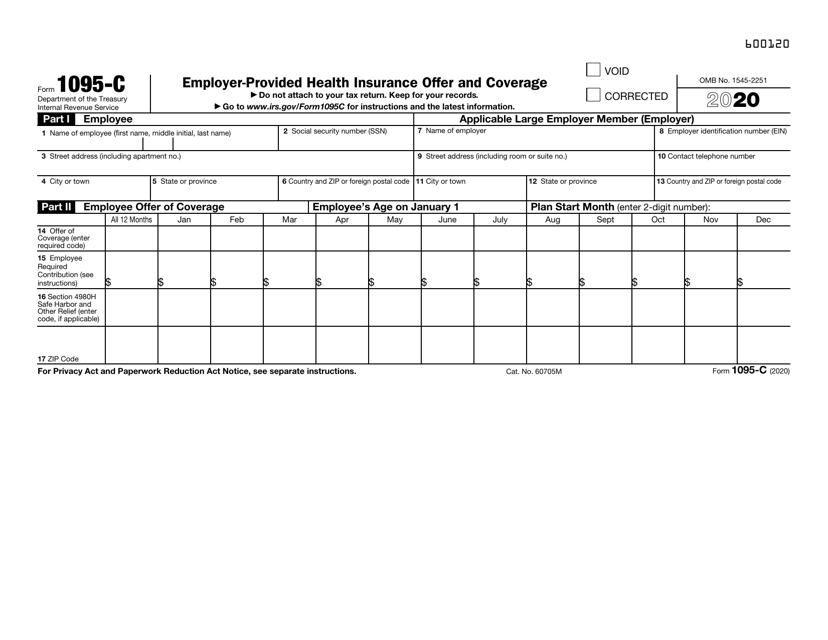

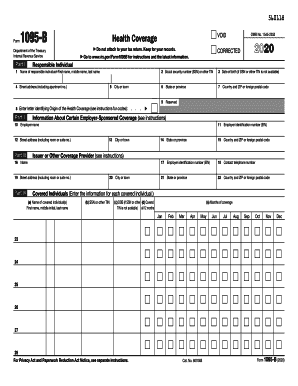

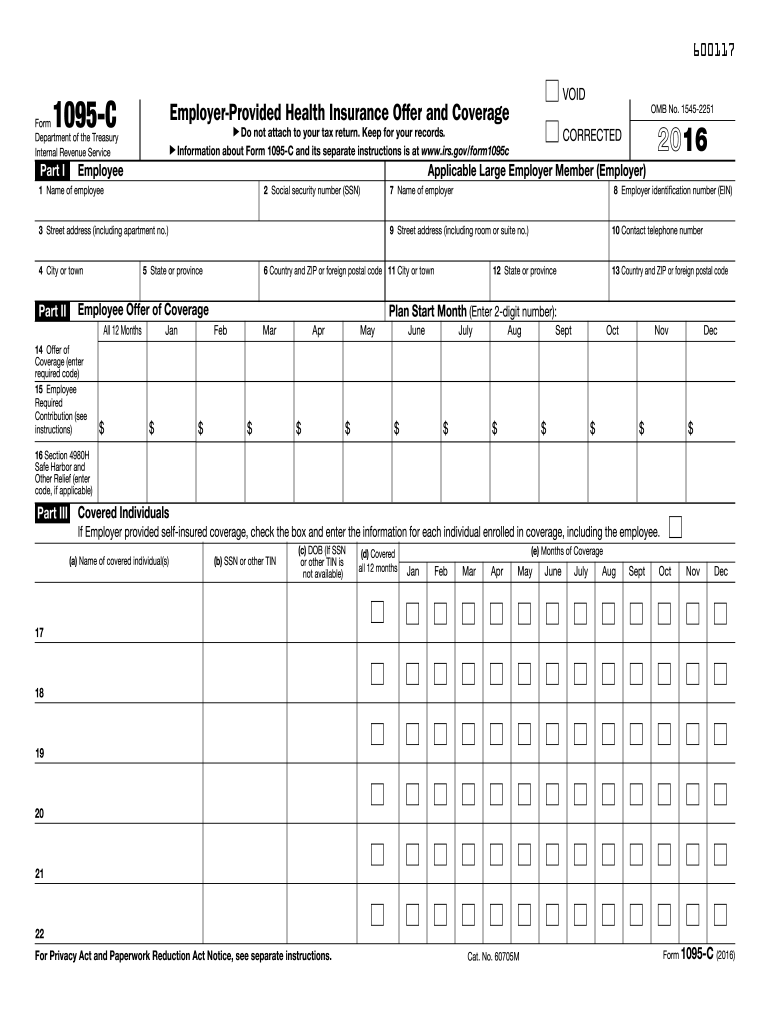

*Updated for tax year 16 In January, aside from receiving your usual Form W2 from your employer, you may receive Form 1095C related to the Affordable Care Act (ACA) If you received health insurance outside of the marketplace exchanges in 16, and worked for a large employer, look for Form 1095C, EmployerProvided Health Insurance Offer and Coverage, to arrive in27/7/ · The IRS released for comments a draft of Form 1095C Employers will use the final version early next year to report on health coverage in The revisions add a second page to the form and mayForm 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was coveredThis form is sent out

The Affordable Care Act (ACA) requires all Applicable Large Employers (ALEs) to offer fulltimeYour 1095 form provides proof of insurance eligibility and coverage for each month of the year If you were enrolled in a medical plan or eligible for coverage but did not elect a medical plan at any point during the year, you should receive a 1095 form The 1095C form is not required to file your income tax return This form is being provided asHome GET ONLINE ACCESS TO YOUR TAX FORMS W2 and 1095C Login Please complete the required fields to continue Employer Name/Code Remember my Employer Name or Code Login >> Find employer name Tax Topics 3;

10/3/21 · As with most IRS forms, the Form 1095C acts as a way for the employer to report the health coverage that an employer made available to each employee Specifically, the form identifies the employee/employer relationship, what months the employee was eligible for coverage, and the cheapest monthly premium available to the employee under the plans offeredThe Form 1095C contains important information about the healthcare coverage offered or provided to you by your employer Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax credit Think of the form as your "proof of insurance" for the IRS1095C – This form is used by fullyinsured and selfinsured ALEs to

Sample 1095 C Forms Aca Track Support

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

FullTime Employee Hired Midyear, Qualifying offer;You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part · For instance, if you changed jobs at some point during the year and were enrolled in coverage with both employers, you would receive a Form 1095C for each employer If you work for an employer who has different franchises or companies In that instance, you may also receive a Form 1095C from each company Why is Part III of my Form 1095C blank?

Ez1095 Software Speeds Up 1095 C Filing With Quick Data Uploading Feature Newswire

Form 1095 C Guide For Employees Contact Us

7/1/21 · In filling this form, it is important to note that the best solution is PDFelement filler program This program allows you to fill out the form easily and very fast You can check boxes, radio buttons and type on your Form 1095C without problems This is particularly very useful as the form 1095C contains a lot of checkboxesYou need to file a form at the serviceACA Form 1095C Line 16 Codes, Section 4980H Safe Harbor and Other Relief Line 16 of Form 1095C is used to report information about the coverage that an employee enrolled in, and how the ALEs meet the employer shared responsibility "Safe Harbor" provisions under Section 4980H

Sample 1095 C Forms Aca Track Support

Aca Reporting Tip 16 Line 16 Union Employees Usi Insurance Services

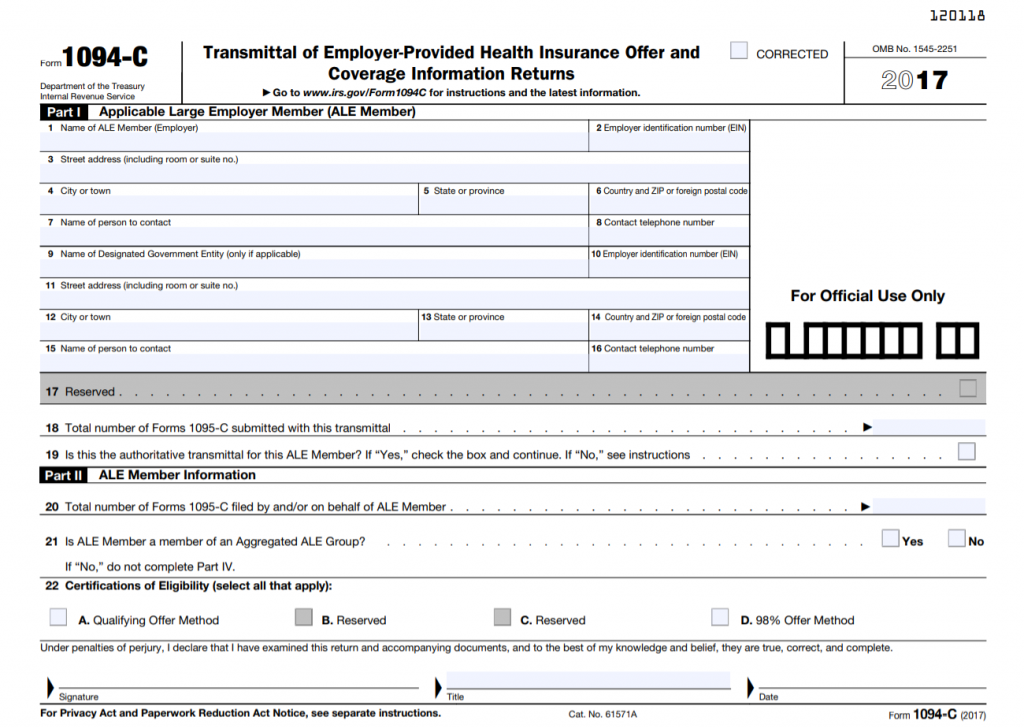

24/2/ · Every year Applicable Large Employers ("ALEs") must file Forms 1094C and 1095C with the IRS and furnish Forms 1095C to employees considered fulltime under the Affordable Care Act ("ACA") Forms 1094C and 1095C are used in combination with the IRS automated Affordable Care Act Compliance Validation (ACV) System to determine whether an ALE owes5/5/17 · *If the rejection is more complicated, for example a Form 1095C was rejected due to a TIN mismatch, ALEs should spotcheck to see whether these are actual errors or falsepositives30/9/18 · In March, you will receive your 1095C form The form can also be used to complete a person's tax return He recalled that an FTA member should only be interested 1 type of health form is a health tax Next calendar year, you may need to complete both your personal tax return 1095c information to prepare the tax return

Irs Form 1095 C Download Fillable Pdf Or Fill Online Employer Provided Health Insurance Offer And Coverage Templateroller

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Reissue – Between the time when Form 1095C are furnished to employees but the Transmittal file has not been submitted to IRS, administrator can reissue Form 1095C to their employees Add a user modified row with the changes required and select the Reissue radio button to indicate that this data row is for issuing a reissue formForms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue To view your Form 1095C in HR/CMS SelfService For anyone who previously chose suppression of paper forms, the Form 1095C is already available online at HR/CMS SelfServiceLet's Look At The Most Common 1095C Coverage Scenarios

1095 C Software 1095 C Software To Create Print And E File Irs Form 1095 C

Checkmark 1095 Software For Aca Reporting Print E File Software

IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095CForm 1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage (for selfonly minimum essential coverage Information about Form 1095C and its separate instructions is at wwwirsgov/form1095c OMB No 15 share of the lowestcost monthly premium Part I EmployeeFullTime Employee Waived Coverage All 12 Months;

1095 C Print Mail s

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

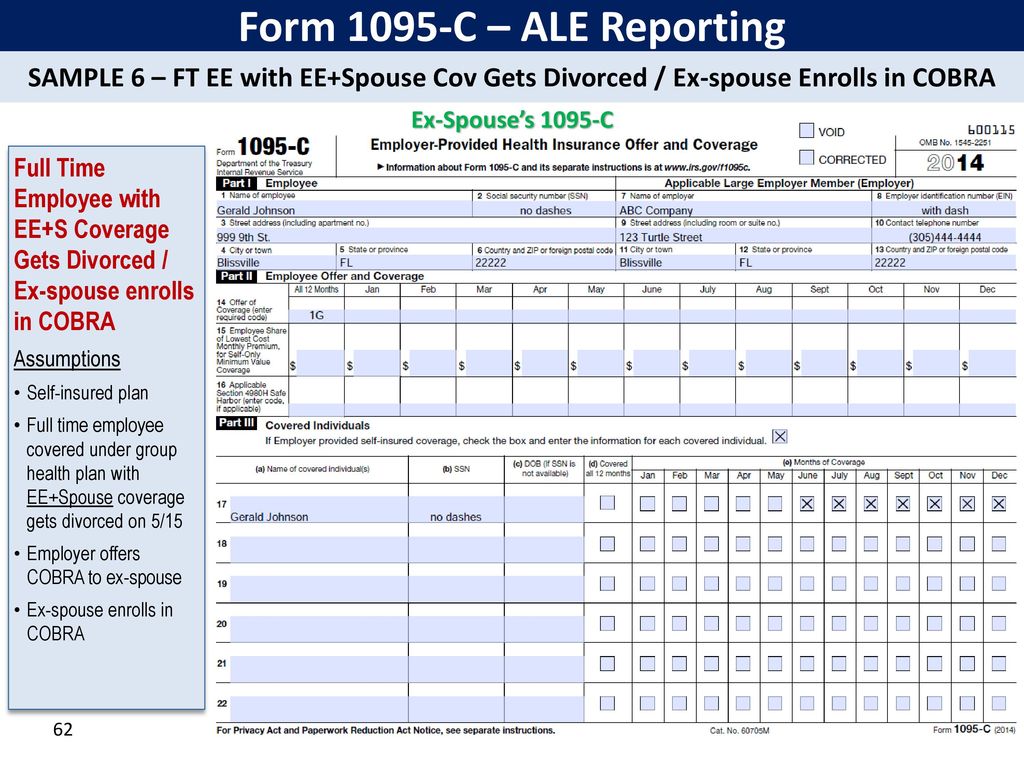

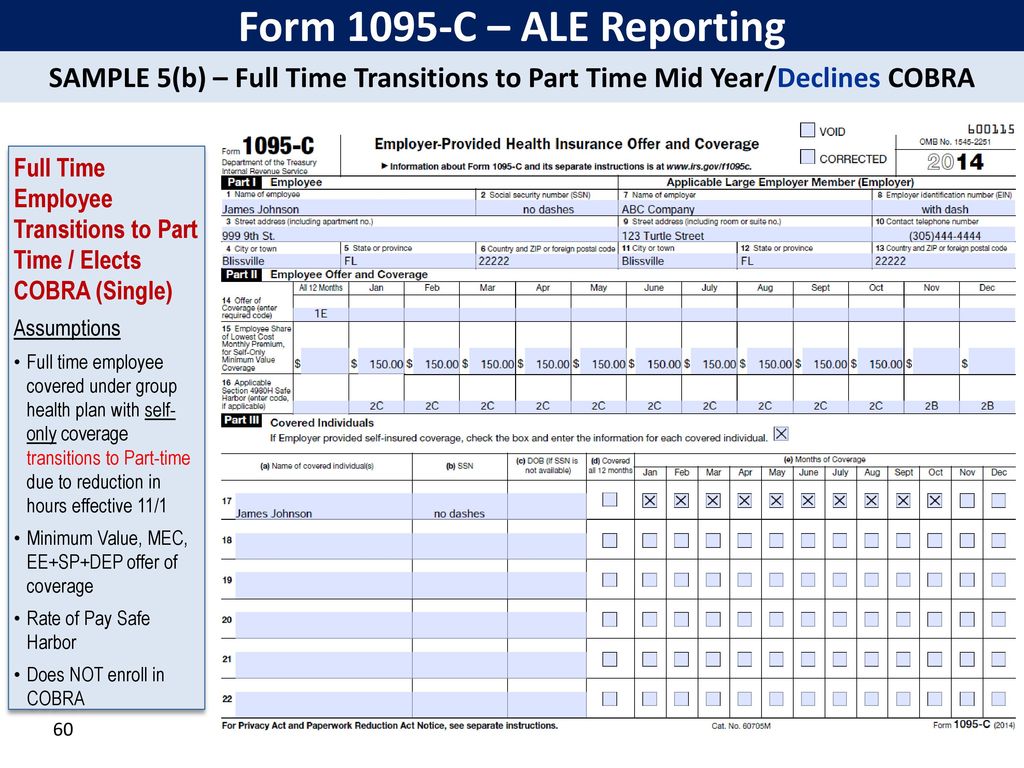

About Form 1095 A Health Insurance Marketplace Statement Definition

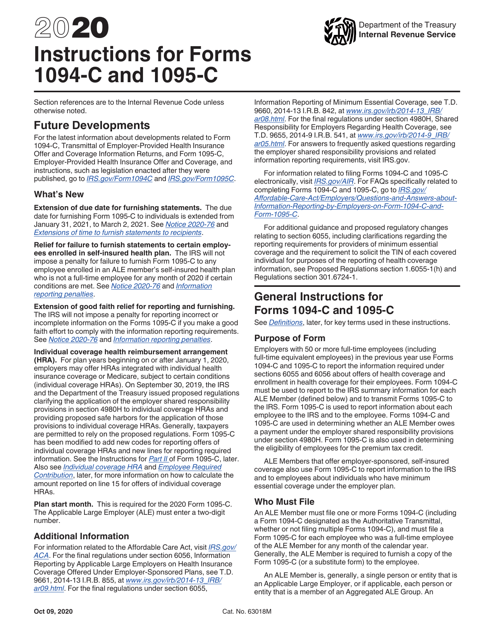

18/1/16 · Form 1094C and Form 1095C (and related instructions) will be used by ALEs (eg employer with 50 or more fulltime employees including fulltime equivalents) that are reporting under Section 6056, and for combined reporting by ALEs that sponsor selfinsured plans required to report under both Sections 6055 and 60563/10/18 · Self‐insured employers must report offers of COBRA coverage Employers complete Form 1095‐C providing COBRA coverage information (enrollment in COBRA coverage) How the Form 1095‐C is completed will depend, in part, on whether the employee was covered as an active employee during 18 · For example, if an employer intends to file a separate Form 1094C for each of its two divisions to transmit Forms 1095C for each division's fulltime employees, one of the Forms 1094C filed must be designated as the Authoritative Transmittal and report aggregate employerlevel data for both divisions, as required in Parts II, III, and IV of Form 1094C

Updated Sample Employee Letters For Irs Forms 1095 B And 1095 C Kistler Tiffany Benefits

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

14/3/21 · Form 1095C compliance isn't always easy, but it definitely doesn't have to be difficult From what it is and how reporting works to updates for the new year and common employee FAQs, find out what HR and employers need to know about Form 1095C What is Form 1095C?Back to Import ACA Data ;Form 1095C An IRS form sent to anyone who was offered health insurance coverage through his or her employer The form includes information you may have to provide on your federal tax return

Form 1095 C Forms Human Resources Vanderbilt University

Form 1095 A 1095 B 1095 C And Instructions

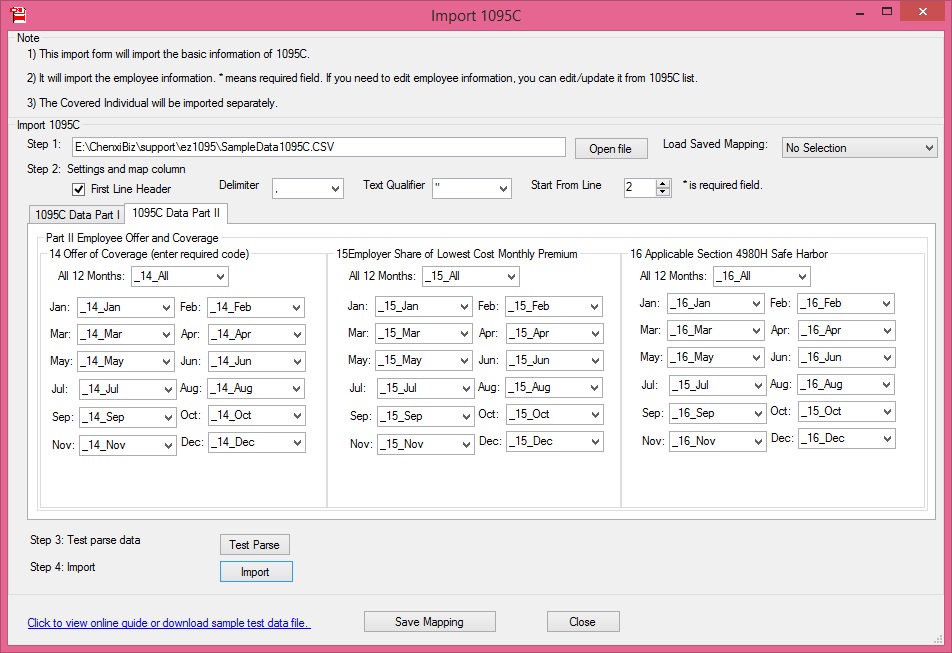

Steps to Import Form 1095C data with ExpressIRSForms With ExpressIRSForms, it's easy to import your Form 1095C data Step 1 Download our custom Excel template for Form 1095C Step 2 Fill in the required Employee, Offer & Coverage, and Covered Individual details Step 3 Upload the Excel template and preview your data as it's processed by/4/16 · You'll send 1094C and 1095C to the IRS, and you'll also give a personalized copy of the 1095C to every single person on your team 3 Which brings us to the next point — there's a good reason for you to fill them out The entire reason these forms exist is to show the IRS that you're providing your team with meaningful health careLine 16 Codes of Form 1095C, Safe Harbor IRS designed the Code Series 2 indicator codes from 2A to 2I to determine affordability For example, if a 2H is entered, this indicates that the employer used the Rate of Pay Safe Harbor to determine the affordability Click here to learn more about ACA Form 1095C Line 16 Codes

Sample Print Of 1095 B And 1095 C 1095 Software

Sample 1095 C Forms Aca Track Support

Form 1095C will help determine if you're eligible If you received coverage through a selfinsured employersponsored health plan, the employer will complete Part III of Form 1095C This information proves that you and any dependents/familyForm 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employeesAnswer 11 Please test with our sample data file (Please follow the step 2 in this guide)

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Form 1095 C The Aca Times

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 16 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095CYou are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, PartThis webinar will provide information on Form 1095A, the tax form that individuals enrolled in a Qualified Health Plan (QHP) must use to complete IRS Form 8

1095 C Fillable Form Fill Out And Sign Printable Pdf Template Signnow

Sample Print Of 1095 B And 1095 C 1095 Software

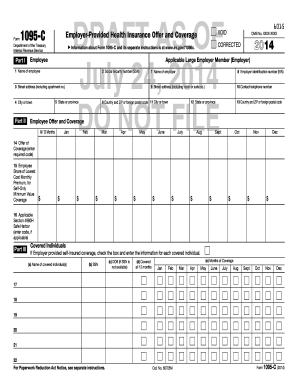

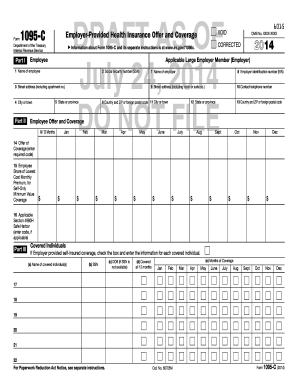

Sample 1095 C form for Year and later Sample 1095 C form for Year 15 to 19 Troubleshooting;18/1/15 · Form 1095C, EmployerProvided Health Insurance Offer and Coverage This form is furnished to those who had employersponsored coverage TIPmore about the reporting requirements here Employers can find out More on 1095B and C FormsForm 1095C This form includes information that will identify which months an individual and any enrolled dependents were offered coverage and if it met the criteria for Minimum Essential Coverage (MEC), affordability, as well as the months during which they participated in the employer's health coverage Parts I, II, and III Form 1095C is

1095 C Form Official Irs Version Discount Tax Forms

Form 1095 A 1095 B 1095 C And Instructions

3/2/15 · 61 Form 1095C must be provided to the IRS by March 31, 17 (filing electronically) Form 1095C must provided to the IRS by Feb 28, 17 (filing paper) 62 I am probably going to need an extension on that one too 62 63 Form 09 is for you then 63 64FullTime Employee Enrolled All 12 Months;The Form 1095C print and the 1094C or 1095C XML files are handled through the JD Edwards Electronic Document Delivery (EDD) system The system uses the data item aliases during the spool file batch export step to create XML source files, which are then used to map the information to The XML XSL (XML transformation file used to map to the IRS

1094 C 1095 C Software 599 1095 C Software

Control Files And Sample Forms

PartTime Employee Becomes FullTime Midyear18/2/21 · 1095B – This form is used by insurance companies to report information about individuals who are covered by minimum essential coverage and are not liable for the individualshared responsibility payment ;According to the IRS, you have to file 1095 C sample if you have obtained health insurance from any of the exchanges provided by healthcare or any of the state exchanges The exchanges are also known as the Affordable Care Act Where to file 1095 C?

Common 1095 C Coverage Scenarios With Examples Boomtax

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Form 1095C is sent to certain employees of applicable large employers Applicable large employers are those with 50 or more fulltime employees Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverageKB Sample EMail The following email is an example only and uses the disclosure requirements set forth in IRS Publication 15a and Treasury Regulations Sub Chapter C Sec (j) Email Subject IMPORTANT TAX RETURN DOCUMENT AVAILABLE Email Body Fabrikam is pleased to offer 1095C statements via email this year instead of the traditional paper copy!Information included in the Form 1095C (including an explanation of Part III for selfinsured plans)

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Ez1095 Software How To Print Form 1095 C And 1094 C

The Form 1095C includes information about the health insurance coverage offered to you and, if applicable, your family You may receive multiple Forms 1095C if you worked for multiple applicable large employers in the previous calendar year You may need to submit information from the form(s) as a part of your personal tax filingHow to Fill Out forms 1094C, 1095C Employer Health Coverage How to Fill Out forms 1094C, 1095C Employer Health Coverage Watch laterQ1 Cannot import data from file or file with bad data;

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

When to file Form 1095 C?Form W2 Questions LEARN MORE >> Form 1095C5/5/ · Common 1095C Coverage Scenarios FullTime Employee Enrolled all 12 Months, qualifying offer;

Irs Streamlined Installment Agreement Unique Form 1095 C Form C Ale Reporting Sample Full Time Transitions Irs Models Form Ideas

Ez1095 Software How To Print Form 1095 C And 1094 C

The format of this spreadsheet matches the industry standard for reporting 1095C information, so your clients' health care providers will be familiar with this format Once the employees' 1095C information has been added to the spreadsheet, you can import this data into Accounting CS via the 1095C spreadsheet import

Filing Aca Form 1095 C Is Easy With Ez1095 Software For School Administrators Newswire

Benefits 1095 C

Sample 1095 C Forms Aca Track Support

Sample Of 1095 C

Free 1095 C Resource Employee Faqs Yarber Creative

Control Files And Sample Forms

Form 1095 A 1095 B 1095 C And Instructions

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Questions Employees Might Ask About 1095 C Forms Bernieportal

1095 Tax Info Access Health Ct

Irs Form 1095 C Fauquier County Va

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Common 1095 C Coverage Scenarios With Examples Boomtax

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Sample Of 1095 C

Guide To Correcting Aca Reporting Mistakes Onedigital

Sample 1095 C Forms Aca Track Support

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Tax Forms Bfi Printing Mailing Services Inc

Annual Health Care Coverage Statements

1094 B 1095 B Software 599 1095 B Software

Covered California Ftb 35 And 1095a Statements

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

1095 C Form Printable Fill Online Printable Fillable Blank Pdffiller

Ez1095 Software How To Print Form 1095 C And 1094 C

1095 C Sample Hcm 401 K Human Resources

1094 C 1095 C Software 599 1095 C Software

What Payroll Information Prints On Form 1095 C To Employees

Ez1095 Software How To Print Form 1095 C And 1094 C

Accurate 1095 C Forms Reporting A Primer Integrity Data

Control Tables And Sample Forms

Ez1095 Software How To Print Form 1095 C And 1094 C

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Fillable Online Employee Phoenix Sample 1095 C Form Employee Phoenix Fax Email Print Pdffiller

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Aca Reporting Penalties Abd Insurance Financial Services

Common 1095 C Coverage Scenarios With Examples Boomtax

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Ez1095 Software How To Correct 1095 C And 1094 C Form

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

How Can I Get My Health Insurance Tax Form Picshealth

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

1095 C Eemployers Solutions Inc

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Sample 1095 C Forms Aca Track Support

Aca Code Cheatsheet

No comments:

Post a Comment